Sometimes we get lots of questions on subjects that are not, shall we say, especially exciting to the layman. But still nonetheless important. Italian payslips is one of those…

Payroll in Italy is generally regarded as one of the most complex. Indeed, in the 2021 Global Payroll Complexity Index, Italy came second only to France.

However, it does not have to be that difficult. You just need a good grasp of the main elements of Italian payslips, which we describe in this blog.

The Italian payslip

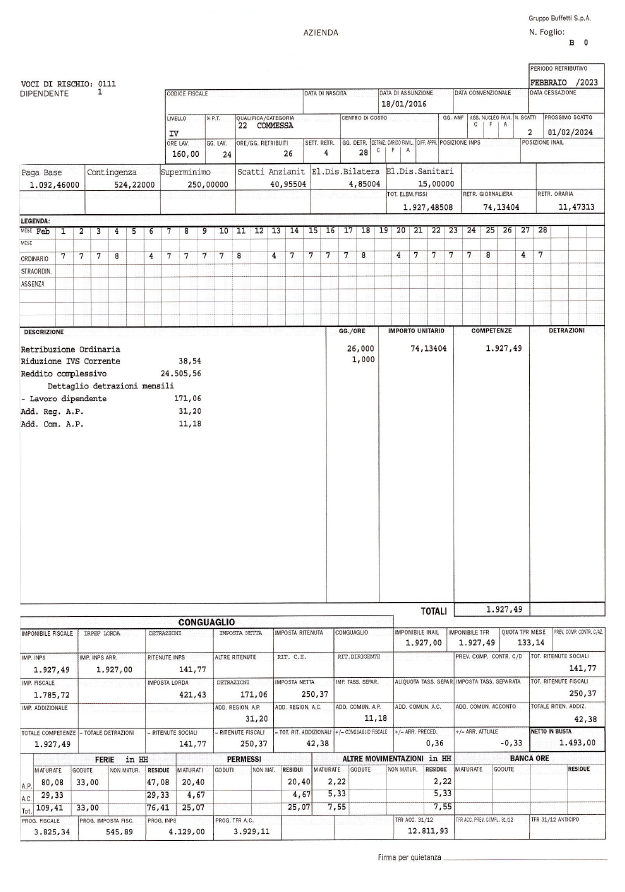

Italian law describes the content that must be included, but does not provide a model template. As a result, Italian payslips vary as to where the key information can be found. However, they will essentially comprise of three sections, with information regarding the employer and employee at the top; with a middle section detailing additional components of gross salary; and, at the bottom the net salary, after social security and tax deductions, as well as the latest position relating to holidays, TFR (i.e. severance pay).

Top section of payslip

As well as the employer’s details and the name of the employee, the top section also provides:

● The month.

● Company, VAT, INAIL (National Institute for Insurance against Accidents at Work) and INPS (National Institute for Social Security) numbers.

● Hiring date

● Position and seniority.

● Days and hours worked.

● Salary, broken down into different parts:

○ Base pay (Paga base) - minimum pay as established by the collective agreement and job level.

○ Contingency allowance (contingenza) - the amount required to adjust the base pay to inflation.

○ Third element (terzo elemento) - an amount that varies depending on location, and is established by union negotiations at regional/provincial level.

○ Other indicators that may arise based on the relevant national collective bargaining agreements.

○ Any other salary components, e.g. based on length of service.

○ Superminimo (if applicable), being the share of salary that exceeds the minimum pay and which can be established individually or through the collective agreement.

Middle section of payslip

This is where you find additional elements that are included in the gross salary for the month. These can differ from month to month, but common elements include:

● Overtime.

● Work performed on holidays.

● Sick days, maternity leave, and vacation days, etc.

● Reimbursement of expenses and reimbursement for mileage.

● Performance bonus.

● TFR advance (severance pay).

● Vacation pay.

Bottom section of the payslip

This is where you find information relating to social security and tax deductions, and of course the net pay for the month, “netto in busta”. Accrued severance pay (TFR) is also found here, as well as:

● INPS - contributions to the National Institute of Social security.

● INAIL - contributions to the National Institute of Insurance for Accidents at Work.

● Ferie - vacation days, both days earned, and days already taken (“godute”)

● Altre movimentazioni - former public holidays that are essentially now hours that the employee treats similar to holidays.

Do you want more information or need help with employment and payroll in Italy?

Internago can assist with full payroll services in Italy as well as other European markets. Please click here to find more information, or if you prefer contact us directly at sales@internago.com or info@internago.com

Disclaimer

Please note that this blog post only gives an overview and provides some introductory examples to payroll in italy. In practice, there are more detailed aspects to consider, which is why this blog post should only be seen as a general guide. For a more in-depth discussion, do not hesitate to contact us at info@internago.com